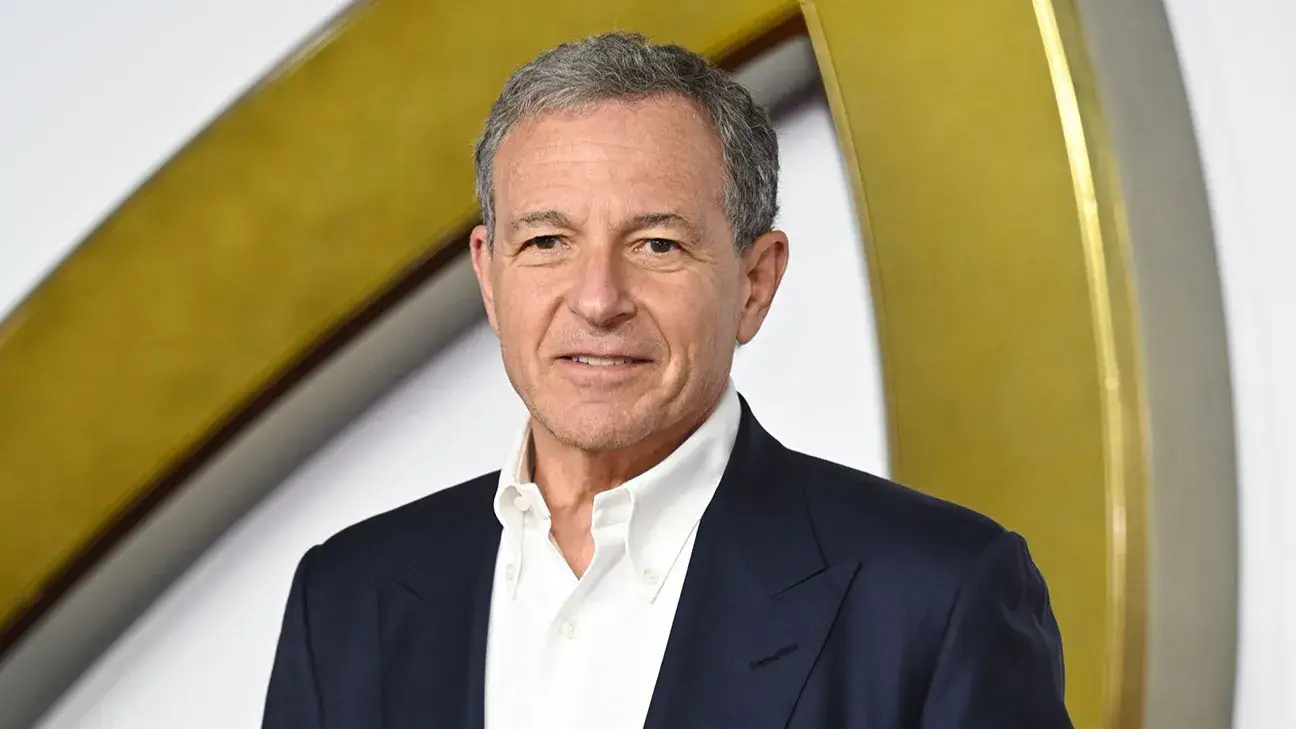

Best of both worlds: The joint venture between Reliance Industries and Walt Disney would be beneficial to the company, increasing profits and ‘de-risking’ operations in the Indian market, according to Walt Disney CEO Bob Iger.

The merger, announced last month on February 28, will form a large conglomerate and help Disney remain in the market at a ‘significant’ level, Iger said while speaking at a Morgan Stanley investor conference earlier this week.

Reliance Industries Limited and Walt Disney have inked binding pacts for the merger of their media operations in the country.

As part of the deal, Reliance and its affiliates will control 63.16 per cent while Disney will own 36.84 in the joint venture. Touted as the biggest media merger valued at $8.5 billion, after the $10 billion Zee-Sony merger fell off, the JV will have 120 television channels and two streaming services as part of it.

“We wanted to stay in India. We made a big investment in India when we purchased the assets of 21st Century Fox. We are one of the biggest media companies in India. But even though it is the most populous country in the world, we felt we want to be there because of that, we also know that there are challenges in that market,” Iger said.

The merger will form a large entity, that will bring the best of both worlds.

“So, it’s kind of the best of both worlds. We stay in the market at a significant level. We have a very good partner in Reliance, and we get to have a chance of growing a business and lowering the risk of doing so,” he added.

Excluding synergies, the merger is valued at Rs 70,352 crore ($8.5 billion) on a post money basis as part of the transaction value.

The Reliance Group, helmed by Asia’s richest individual Mukesh Ambani will also invest Rs 11,500 crore to bolster the joint venture, which will rival streaming giant Netflix and the Japanese Sony Group in the entertainment sphere.

Nita Ambani, chairperson of the Reliance Foundation, is likely to chair the merged entity.

Disney+Hotstar, the OTT platform saw the subscriber base for paid users go down from 55 million to 40 million in the first quarter of FY24 on the back of Reliance’s Jio Cinema snatching up exclusive rights for the Indian Premier League, and live sports.

When combined, the two entities will have the most subscribers on its OTT -platform.

Disney+Hotstar was launched in 2020 in India, after Disney acquired 21st Century Fox Star Studios in 2019 in a deal valued at $71.3 billion – which also enabled it to take over the operations of Star India and Hotstar. This also brought into the entertainment mix, companies such as StarPlus and StarGold as well as sports channel Star Sports, among others.

The entity rapidly increased subscriber base in its initial days, repping up the streaming rights of the Cricket World Cup and the Indian Premier League, in a market dominated by cricket fans in the sports spectrum.

Disney+Hotstar had to, however, let go of its bid for streaming rights in the 2023-27 cycle after Reliance’s Viacom 18 won the deal for $720 billion, which was at a 12.92 per cent higher price than what Star India paid on average per match.

Reliance houses its media ventures in Network 18, which controls TV18 news channels and a host of entertainment channels under the Colors brand umbrella, and sports outlets.

NW18 also holds shares in moneycontrol.com, bookmyshow and publishes magazines like Forbes and Overdrive.

The Reliance media arm also controls news channels CNBC/CNNNews.

Separately, the Reliance Group has ownership of a movie production arm – JioStudios, and controls majority shares in the listed cable distribution companies Den and Hathway.

(With PTI Inputs)