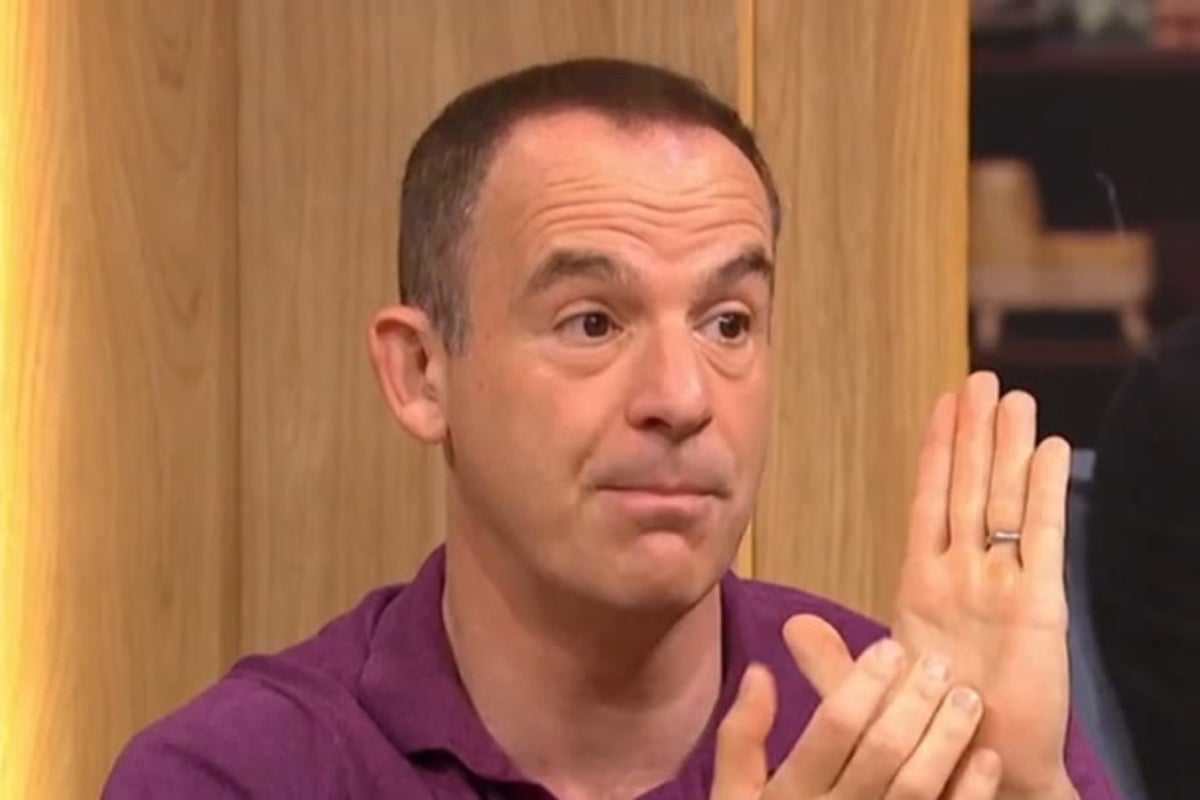

Martin Lewis has shared how Brits can secure a much-needed financial boost of up to £400 in time for Christmas.

There are now seven banks offering a cash incentive for account switchers, with many also offering other perks such as cashback and high interest rates.

This time of year is the “sweet spot” for bank switching, Mr Lewis said, with the latest paying out around early December if savers act now.

Speaking on BBC’s The Martin Lewis Podcast, the money guru said: “As there are seven banks, and they’re all winning to bribe you (legally) with free cash, I’m calling it the magnificent seven.”

The best offer currently on the market is available to high earners only, as Barclays offers £400 to switch to its Premier Current Account, which requires a salary of £75,000.

However, there are several others which most other savers can take advantage of currently on the market. Here’s an overview of the switching deals currently available:

TSB Spend & Save – up to £210

This is the best deal “for most people”, Mr Lewis said, offering an upfront cash offer of £150. However, this can be boosted up to £210 if taking advantage of cashback offers exclusive to new switchers.

This can be worth a maximum of £10 a month for three months, and then £5 a month for six months, adding up to £60 if used in full. This can be qualified for each month by making 20 or more debit card payments.

The account also provides access to a regular saver, which offers 5 per cent interest on up to £250 a month, fixed for 12 months. This equals a maximum of £71 interest.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Club Lloyds – £200

Lloyds is offering £200 to switch to its Club account. The deal also provides access to a competitive 6.25 per cent interest regular saver and allows for fee-free overseas spending.

This account also provides a yearly reward, allowing holders to choose from 12 months’ Disney+ (with ads), six cinema tickets, a Coffee Club and Gourmet Society membership, or a subscription to a magazine. This costs £5 a month unless at least £2,000 a month is paid in.

Barclays Bank Account – £200

Barclays is offering £200 a month to new switchers who join its Blue Rewards Scheme. This costs £5 a month and requires a minimum of £800 a month to be paid in.

For this fee, account holders gain a free Apple TV+ subscription (normally £9.99 a month) and a free Major League Soccer Season Pass subscription (normally £14.99 a month).

However, savers can opt out of the scheme once they receive their cash if they do not want to pay the monthly fee.

First Direct 1st Account – £175

Digital bank First Direct is offering £175 to new switchers, access to a strong 7 per cent interest savings account, fee-free overseas spending, and a £250 overdraft at zero per cent. The bank is also regularly credited for its strong customer service.

Nationwide FlexDirect – £175

Building society Nationwide is offering switchers a free £175, plus 5 per cent interest on up to £1,500, 1 per cent cashback for the first 12 months, and a 6.5 per cent regular saver.

NatWest Reward – up to £211

NatWest is offering a £175 switching bonus, plus £36 a year cashback for a total package of £211. This also comes with a 5.5 per cent interest regular saver.

Co-op Bank Current Account – up to £175

Co-op is offering £100 to switch, plus £25 a month for three months and a 7 per cent interest regular saver.