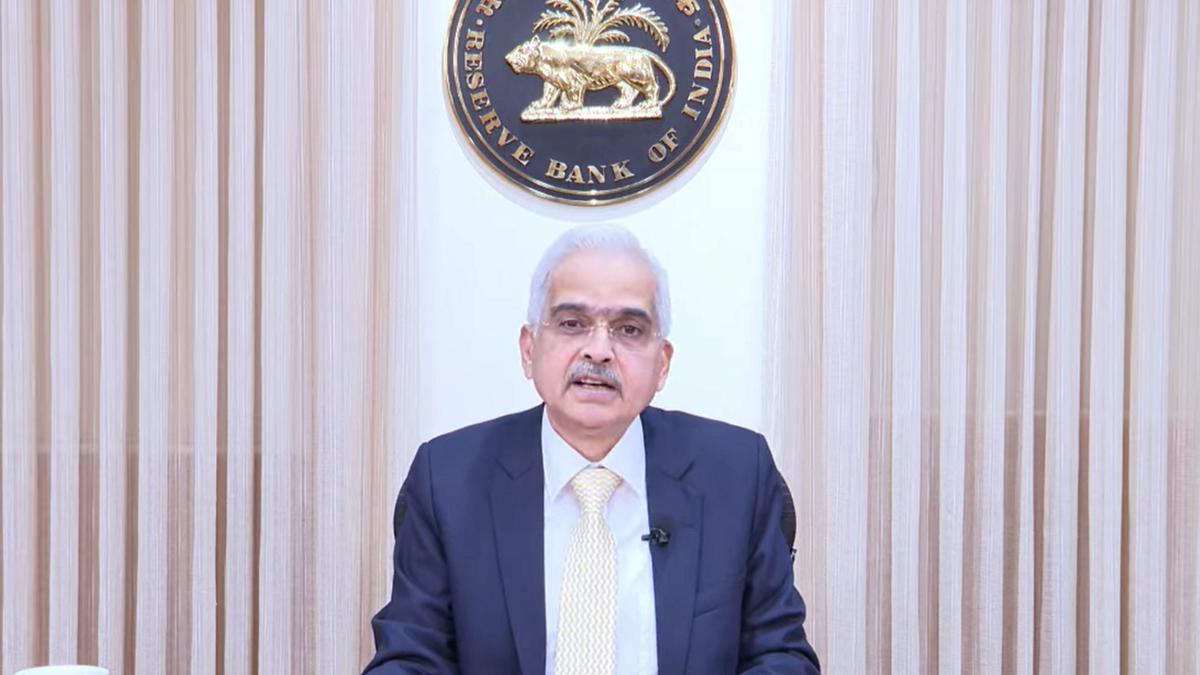

Reserve Bank of India Governor Shaktikanta Das. File

| Photo Credit: PTI

Digital Rupee users will soon be able to execute transactions in areas with limited internet connectivity as the Reserve Bank of India (RBI) on February 8 announced that offline capability will be introduced on the Central bank digital currency (CBDC) pilot project.

RBI Governor Shaktikanta Das said that programmability-based additional use cases will be introduced as part of the pilot project. RBI launched a pilot of the retail CBDC in December 2022 and achieved the target of having 10 lakh transactions a day in December 2023.

It can be noted that other payment platforms, especially the very popular Unified Payments Interface (UPI), already offer offline possibilities.

“It is proposed to introduce an offline functionality in CBDC-R (Retail) for enabling transactions in areas with poor or limited internet connectivity,” Mr. Das said while announcing the bimonthly monetary policy review.

He said multiple offline solutions, which include both proximity and non-proximity based ones, will be tested across hilly areas, rural and urban locations for the purpose.

On the programmability front, he said that currently, the system enables Person to Person (P2P) and Person to Merchant (P2M) transactions using digital rupee wallets provided by pilot banks.

“It is now proposed to enable additional use cases using programmability and offline functionality,” he said.

“The programmability feature will permit users such as government agencies to ensure that payments are made for defined benefits,” he said, adding that corporates will also be able to programme specified expenditures like business travel for their employees.

“Additional features such as validity period or geographical areas within which CDBC may be used can also be programmed,” he said.

Meanwhile, Mr. Das also announced RBI’s intent to enhance the security features of Aadhaar enabled Payment Systems (AePS), which was used by 37 crore people in 2023.

“To enhance the security of AePS transactions, it is proposed to streamline the onboarding process, including mandatory due diligence, for AePS touch point operators, to be followed by banks,” Mr. Das said, adding that instructions on the same will be issued shortly.

At present, Mr. Das said lenders are using the SMS method for complying with the additional factor authentication requirements but advancements in technology have opened up newer means.

“To facilitate the use of such mechanisms for digital security, it is proposed to adopt a principle-based “Framework for authentication of digital payment transactions”,” he said.