Nobel laureate Muhammad Yunus, who was recommended by Bangladeshi student leaders as the head of the interim government in Bangladesh, waves at Paris Charles de Gaulle airport in Roissy-en-France, France August 7, 2024.

| Photo Credit: Reuters

Filling the leadership vacuum in Bangladesh, albeit temporarily, Nobel Laureate and economist Muhammad Yunus has taken oath as head of the interim government. The 84-year-old microfinance pioneer will head the government until fresh polls are held. The parliament has already been dissolved by the nation’s president Mohammed Shahabuddin.

“If action is needed in Bangladesh, for my country and for the courage of my people, then I will take it,” Mr.Yunus said on Tuesday, a day after Ms. Hasina resigned and left the country. He was called on by student coordinators of the Anti-Discrimination Student Movement to head the interim government.

Banker to the poor

“In Dr. Yunus, we trust,” wrote Asif Mahmud, a key leader of the Students Against Discrimination (SAD) group, in a Facebook post, echoing the widespread acceptability Mr. Yunus has in Bangladesh’s fractious polity.

Born on June 28, 1940, in Chittagong, East Bengal (now Bangladesh), Muhammad Yunus, the third of nine children, completed his primary education at Lamabazar Primary School and then studied at the Chittagong Collegiate School. After completing both a B.A. and an M.A. in Economics from Dhaka University, he started his teaching career as a lecturer in the same university in 1961. Obtaining a PhD in economics from Vanderbilt University, Dr. Yunus began his tenure as an assistant professor of economics at Middle Tennessee State University in Murfreesboro, U.S., in 1969.

As war ravaged his homeland, as it struggled for liberation from Pakistan, Dr. Yunus lobbied the U.S. Congress to stop military aid to Pakistan. He also helped raise support for the Liberation movement by running a Bangladesh Information Center in Washington D.C, and a Citizen’s Committee in Nashville, Tenessee, along with publishing the Bangladesh Newsletter.

With the birth of Bangladesh, he returned home, joining the Economics Department of the University of Chittagong in 1972. As the newly-separated Bangladesh suffered a famine in 1974, he forayed into rural economics, introducing the Nabajug Tebhaga Khamar to study economic aspects of poverty, and urged his students to lend a hand to farmers in fields. In his visits to farming households in Chittagong’s Jobra region, he realised the necessity and effectiveness of small loans to women bamboo furniture makers, freeing them from claws of loan sharks. Initiating the first ‘small loan’, Dr. Yunus lent $27 to 42 families in Jobra to manufacture their items for sale.

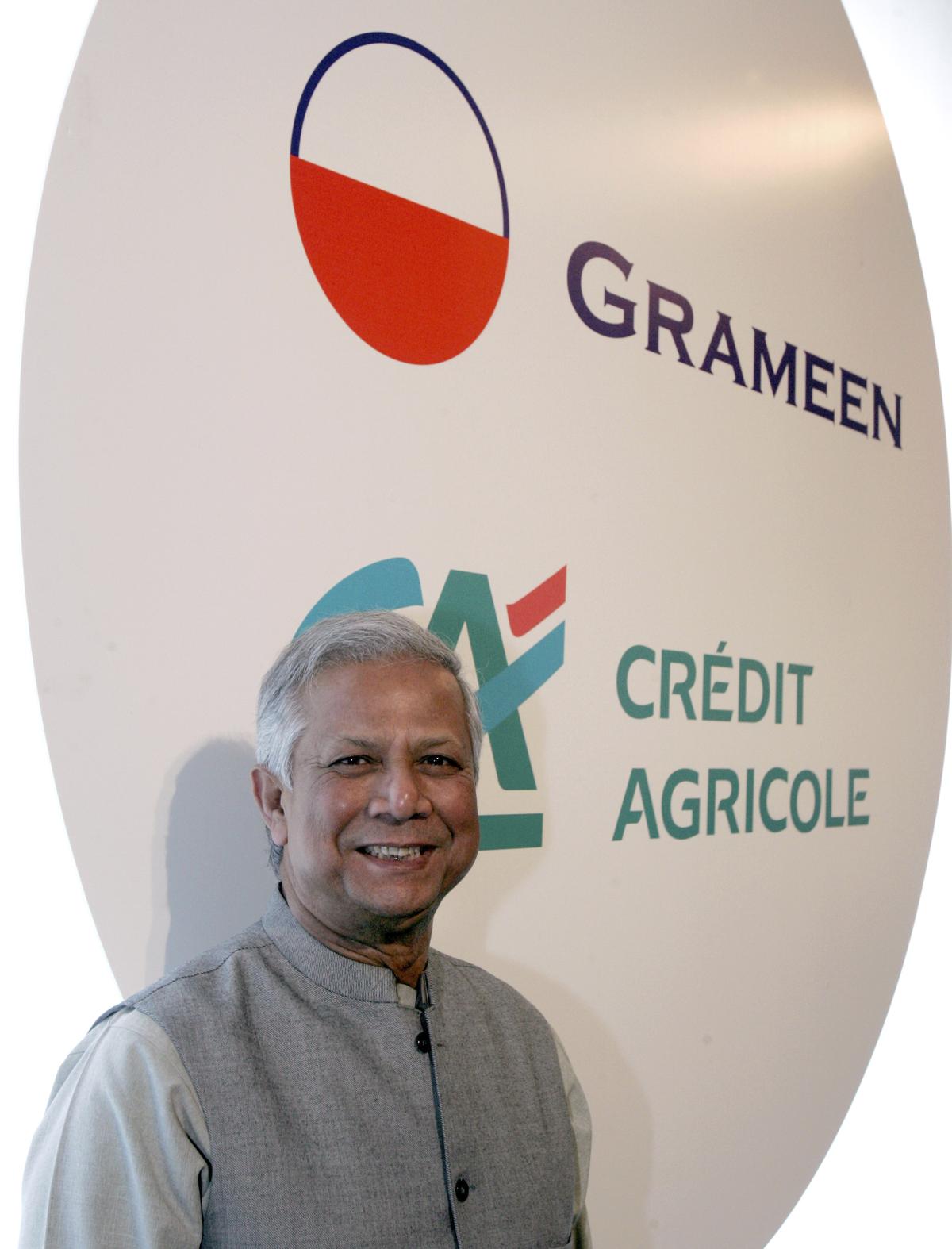

FILE- Muhammad Yunus, an economist from Bangladesh who founded the Grameen Bank and won a Nobel Peace Prize, is seen at the end of a press conference in Paris Monday Feb. 18, 2008.

| Photo Credit:

AP

This idea gave rise to microfinance in 1976, where Dr. Yunus offered himself as the guarantor and secured a credit line from Janata Bank to lend small loans to Jobra residents. In 1983, the Grameen Bank was established, specialising in small loans and playing a pivotal role in eradicating poverty via micro-credit requiring no collateral. Over 100 nations, including India, have replicated this model. As of 2024, Grameen Bank has 2,568 branches across 81,678 villages with 10.61 million borrowers.

Dr. Yunus’ pioneering work in microfinance won him the Nobel Peace Prize in 2006 for lending a social conscience to capitalism and “their efforts to create economic and social development from below” in Bangladesh. However, it also attracted legal trouble in Bangladesh.

Brief political foray

Ahead of the 2006 polls, the Bangladesh National Party (BNP) and Sheikh Hasina’s Awami League (AL) failed to agree on a candidate to head the caretaker government, leading to the imposition of a state of emergency in Bangladesh. With both Khaleda Zia and Sheikh Hasina incarcerated by the military-backed government on extortion charges, Mr. Yunus announced that he would contest in the next polls by forming the Nagorik Shakti party in February 2007. However, he dropped the plans within months due to lack of public support.

Clash with Hasina government

On coming to power in 2009, Ms. Hasina’s government began scrutinising Mr. Yunus and Grameen Bank. In 2011, he was removed as managing director of the microlending bank, as he had passed the retirement age of 60. While he challenged his ouster, he lost the court battle accusing Ms. Hasina of targetting him. On multiple occasions, Ms. Hasina has accused Mr. Yunus for influencing the World Bank, which cancelled a $1.2 billion credit for the Padma Multipurpose Bridge Project in 2012 – a charge which he has refuted. Over 150 cases have been filed against Mr. Yunus by the Hasina government as of 2023.

The micro-financing model itself came under the scanner after Mr. Yunus admitted that some organisations may have abused the system for profit. The lack of collateral in such loans have attracted high interest rates by some banks, leading to borrowers falling into more debt. In 2019, an arrest warrant was issued against Mr. Yunus for three alleged breaches under the Labour Act.

In May 2023, Bangladesh’s Anti-Corruption Commission (ACC) accused Mr. Yunus and several others of misusing the workers’ welfare fund of Grameen Bank and regularising 101 staff members. After a lengthy trial, Mr. Yunus and his colleagues were convicted in January this year, mere days after Ms. Hasina began her fourth consecutive term as Prime minister.

“We have incurred the annoyance of someone because of chasing the three zero dream (zero poverty, zero unemployment and zero net carbon emissions),” said Dr. Yunus after his conviction, as thousands pleaded with the then-PM to pardon him.

Within six months, chaos and violence was unleashed in Bangladesh due to anti-quota protests, leading to a stringent crackdown by police. As student protestors sought one single demand – the resignation of Sheikh Hasina, the 78-year-old politician fled to India, ending her 15-year reign. Now Ms. Hasina, whose government sought to incarcerate him, is out of power and out of the country, while Mr. Yunus is heading an interim government, tasked with overseeing an orderly political transition.