American president Donald Trump’s restrictive trade policies could permanently damage growth in some economies and not all risks have been priced in yet said Reserve Bank of India (RBI) governor Sanjay Malhotra on Friday.

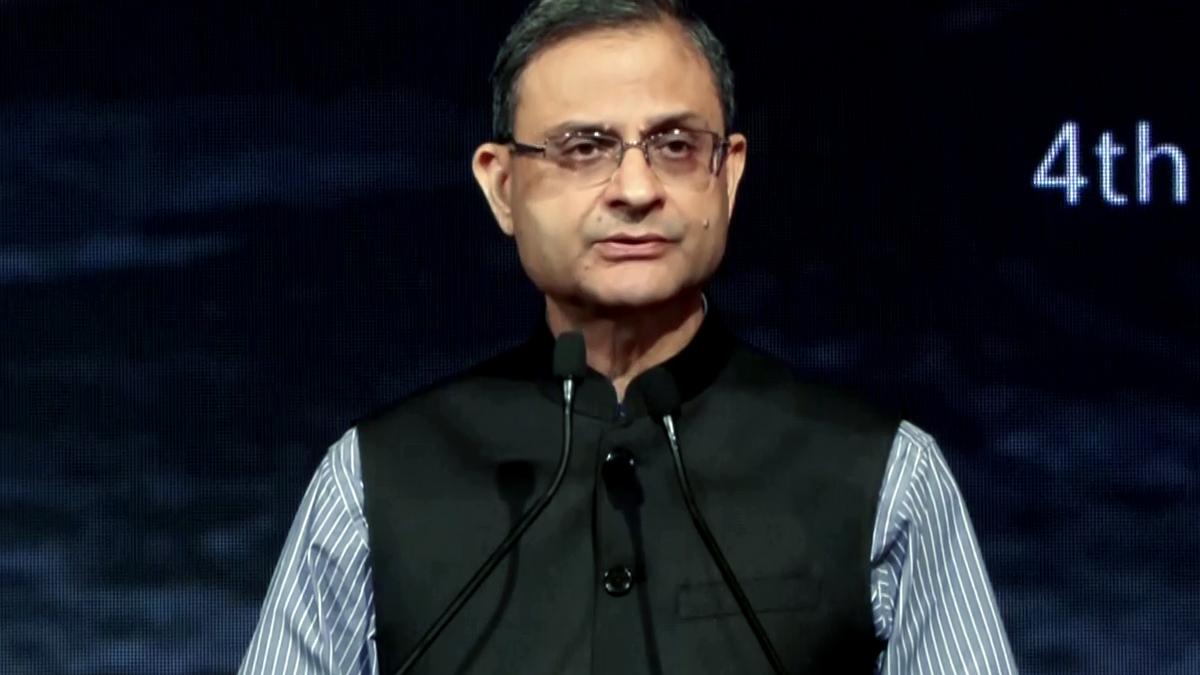

“Despite high US tariff, trade restrictions and uncertainties going forward, the global economy has stayed surprisingly resilient till now. Growth has been upbeat defying projections, even though uncertainty has become a pervasive element of a contemporary discourse. Its tangible effects on real economy have thus far been muted. We have more to see as to how it unfolds,” Mr. Malhotra said while speaking at the Kautilya Economic Conclave.

However, the global economy would underperform to its true potential for some time to come on the diverging growth trajectories across economies, he emphasised.

“Moreover, current trade policy environment and restrictions could damage, perhaps permanently, growth in some of the economies,” he said.

Stating that fiscally almost every country today is quite stressed, he said how the situation could be normalised, especially if the world goes into a phase of lower economy growth, is not apparent.

“This is a risk for all of us, particularly when it is not accompanied by high inflation, though some of the large economies still have inflation above target, but it is not too high,” he said.

“Only some fiscal risks are being priced in by the bond markets, and equities continues to rise. Bond issuance have steepened….while central banks in advanced economies are concerned about the elevated levels of public debt in their economies and worry about a disruptive resolution, full risks perhaps are not being priced in,” he stated.

“This raises a spectre of fiscal dominance, where monetary policy could become constrained by the need to ensure debt sustainability,” he pointed out.

The governor said equity markets, especially global stocks, too seemed to be a bit complacent.

“They have been particularly buoyant, led by technology stocks, leading to worries that a correction might be in the offing,” he cautioned.

In all likelihood, the tariffs combined with large and stretched public debts almost everywhere in the world, would have some material impact on the respective economies, and therefore on the global economy, Mr Malhotra stated.

“As of now, it seems these risks are perhaps not being priced in the equity markets. And there is a greater tolerance too for inflation. While inflation is currently range-bound across most advanced countries, it is still running somewhat higher than the targets,” he pointed out.

He said perhaps gold prices now are showing the kind of movement that oil used to, that is acting as a barometer of global uncertainty.

“Overall, despite heightened uncertainty, global financial conditions now recently have eased. Near-time global financial stability risks have reduced or are not apparent at this time,” he said.

The Governor said in this era of turbulence and heightened uncertainty India’s macroeconomic fundamentals have remained very strong, built assiduously over the decades.

“We have strong forex reserves, low inflation since February, a narrow current account deficit, a very credible fiscal consolidation path, and very strong balance sheets of our banks and corporates,” he said.

“This is to be attributed to the steadfast attention to ensuring macroeconomic stability, price stability, financial stability, and even policy stability, despite changes in government,” he pointed out.

“Continuity in reforms momentum, adoption of global best frameworks, tailored to our domestic needs and national priorities, is the combined efforts of the governments, policymakers, regulators, regulators, all in all. Despite recent odds, the economy seems well settled into an equilibrium of resilient growth,” the governor highlighted.

“This is quite a feat for a larger mortgaging market and makes India stand out as an anchor of stability in a volatile world,” he concluded.

Published – October 03, 2025 07:59 pm IST