Forex traders said the crude oil level of $69 per barrel will act as a support for the domestic unit as India, the world’s third-largest oil importer, stands to benefit from cheaper oil.

| Photo Credit: The Hindu

The rupee traded in a narrow range on Wednesday (September 11, 2024) and appreciated 2 paise to 83.96 against the American currency, on easing crude oil prices and tracking its Asian peers.

Forex traders said foreign institutional inflows, alongside significant corrections in asset classes like the dollar index and crude oil prices, supported the rupee, while the Reserve Bank’s active intervention kept the rupee in a tight range.

At the interbank foreign exchange market, the local unit moved in a narrow range. It opened at 83.97 against the American currency and was at 83.96 in initial trade, registering a rise of 2 paise over its previous close.

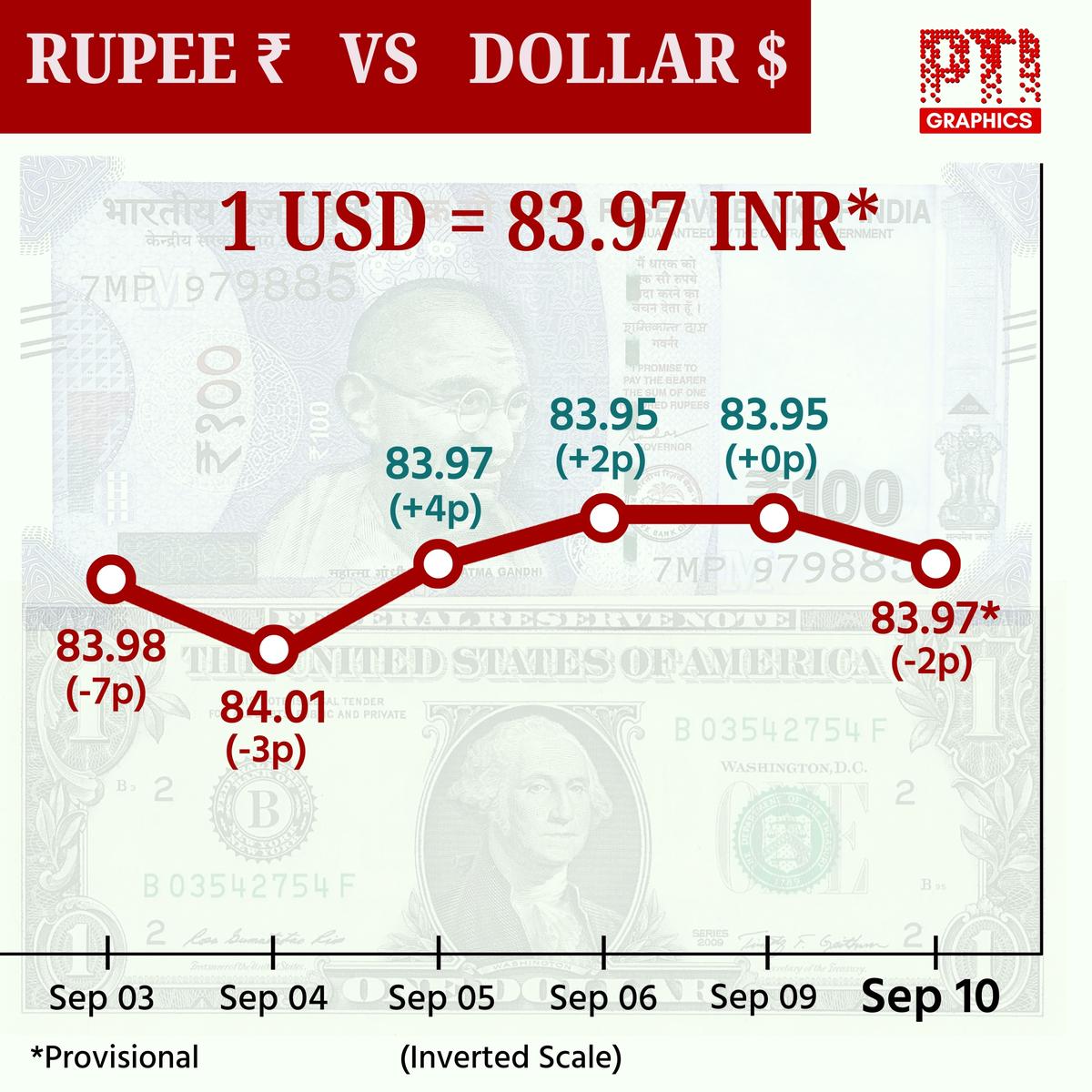

On Tuesday (September 10, 2024), the rupee depreciated 3 paise to close at 83.98 against the American currency.

The rupee falls 2 paise to close at 83.97 against U.S. dollar on Tuesday (September 10, 2024).

| Photo Credit:

PTI

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was down 0.21% to 101.42 points.

Brent crude, the international benchmark, was trading higher by 0.48% to $69.52 per barrel in futures trade.

Forex traders said the crude oil level of $69 per barrel will act as a support for the domestic unit as India, the world’s third-largest oil importer, stands to benefit from cheaper oil.

“The Indian rupee cannot remain in such a state for long as fundamentals clearly indicated gains for rupee with a fall in oil prices, good economic fundamentals, rise in Asian currencies and rising interest differentials should allow RBI to allow the rise in rupee,” Anil Kumar Bhansali, Head of Treasury and Executive Director Finrex Treasury Advisors LLP.

Bhansali further said that over a longer term, 83.97 looks to be a good selling level for exporters despite a higher Real Effective Exchange Rate (REER), which the Reserve Bank may have to ignore for the moment. For the day, 83.90 to 84.05 should be the range.

On the domestic equity market, the 30-share BSE Sensex declined 104.25 points, or 0.13%, to 81,817.04, while the Nifty was down 33.05 points, or 0.13%, to 25,008.05.

Foreign Institutional Investors (FIIs) were net buyers in the capital markets on Tuesday, as they purchased shares worth ₹2,208.23 crore, according to exchange data.

Published – September 11, 2024 10:36 am IST