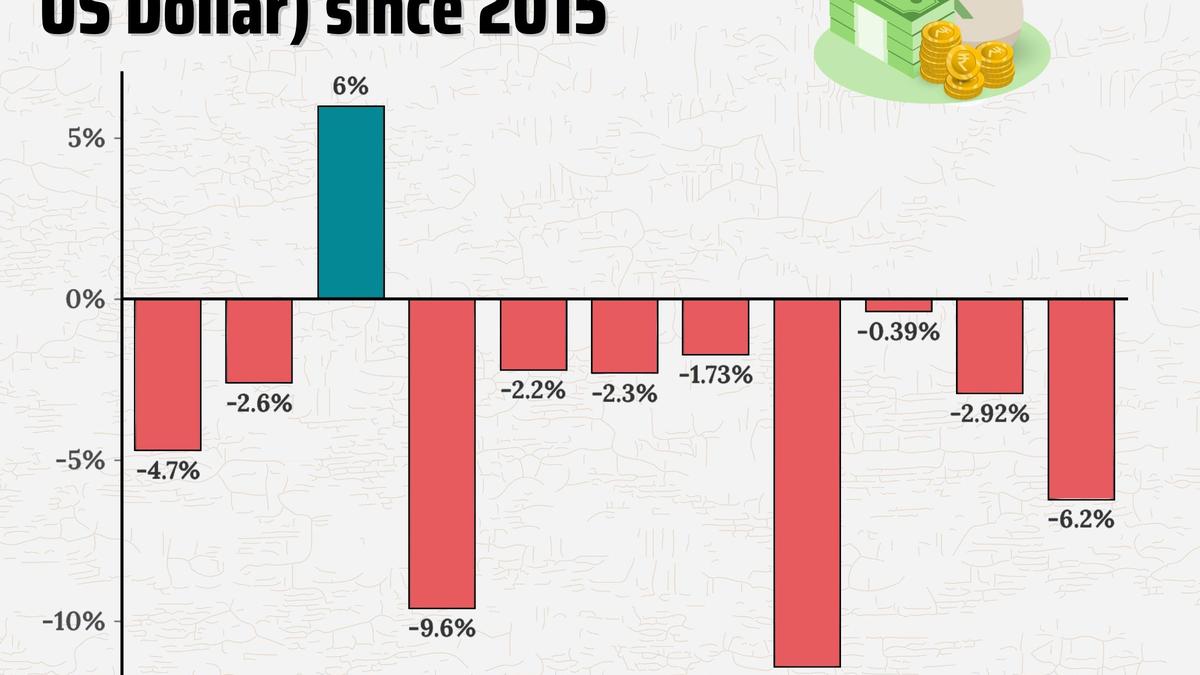

The rupee fell 23 paise against the greenback to settle at a new all-time low of 91.01 (provisional) on December 16. A look at the yearly fall in the rupee against the USD since 2015.

| Photo Credit: PTI Graphics

The forex markets, particularly the Indian rupee, witnessed some volatile movements in the year 2025. The rupee breached the 90-mark against the U.S. dollar several times in the year.

At a sharp depreciation of 4.3% against the U.S. Dollar (USD) in this calendar year (January-December 2025), the INR has become the worst performing currency in Asia, forex analysts said.

The rupee has been on a declining trend since May 2025, and it hit a fresh low at the end of August at a little more than ₹88 per dollar. After this, analysts forecast that if the central bank did not step in at ₹89 a dollar, it would go as high as ₹90 a dollar.

On December 16, 2025, the Rupee breached the 91-mark against the dollar. The slide was stated to be due to the lack of clarity on India-U.S. trade deal.

Particularly in December, the Indian currency breached the 90-mark against the USD several times. Analysts stated that rupee’s recent fall against the U.S. dollar was primarily driven by external factors, not domestic economic weakness, and the high volatility in the forex market is expected to persist amid shifting economic and geopolitical cues.

On January 1, 2025, the rupee was at 85.22 per dollar. During that month, the rupee oscillated between 85 and 86. It ended at 86.20 per dollar on January 31, 2025.

On December 1, 2025, the rupee started at a low of 89 per dollar and breached the 90-mark on December 16, 2025.

The best exchange rate in 2025 was on May 5, 2025 and the worst exchange rate was on December 16, 2025.

On December 26, 2025, the USD/INR exchange rate fell to ₹89.7560 down 0.44% from the previous session. The rupee went down by 5.12% over the last 12 months. Historically, the USD/INR rate reached an all time high of 91.38 in December 2025.

Some of the major movements in the market that are weakening the rupee include pressure on exports owing to U.S. tariffs; a sudden surge in gold and silver imports adding weight to the ballooning import bill; and most importantly Foreign Portfolio Investors (FPIs) pulling out in large numbers from Indian equity.

On October 1, 2025, the RBI announced a slew of measures, including allowing banks to lend in Indian rupees to non-residents from Bhutan, Nepal and Sri Lanka for bilateral trade. Observing that India has been making steady progress in the use of the Indian Rupee for international trade, RBI Governor Sanjay Malhotra said permission has been granted to Authorised Dealer banks to lend in Indian Rupees to non-residents from Bhutan, Nepal and Sri Lanka for cross-border trade transactions.

On November 24, 2025, the rupee clawed back part to shed its earlier losses by appreciating 50 paise to settle at 89.16 against the U.S. dollar. On November 21, it closed at 80.66, a historic low. The recovery was aided by the likely intervention from the RBI, the forex dealers said.

On December 5, 2025, RBI Governor Sanjay Malhotra said the central bank did not target any band for the rupee in the forex market, and allows the domestic currency to find its own correct level. The Governor’s statement came at a time when the rupee breached the 90-mark against the U.S. dollar, and is hovering near that level.

“We don’t target any price levels or any bands. We allow the markets to determine the prices. We believe that markets, especially in the long run, are very efficient. It’s a very deep market,” the RBI Governor said while replying to a question on rupee depreciation at a post-monetary policy press meet. Mr. Malhotra said fluctuations in the market keep taking place, and the effort of the RBI is always to reduce any abnormal or excessive volatility.

If the uncertainty over the India-U.S. trade deal continues and with the rising gold and silver prices, the Indian rupee will likely to weaken further in the months to come.

Published – December 29, 2025 01:30 pm IST