Analysis: Interest rates cut will be notable after rampant inflation

Our business correspondent Karl Matchett writes…

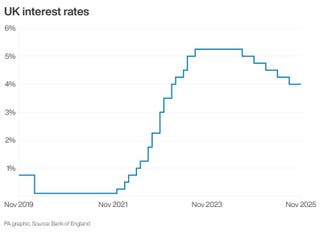

Assuming the rate cut does indeed arrive, it’ll be a notable one: the lowest that the base rate has been for nearly three years, since it jumped from 3.5 per cent to 4 per cent in February 2023.

This year we’ve had three rate cuts already and the last time we had four or more in a single year was way back in 2008, when we had five in quick succession in the aftermath of the financial crisis.

Very different circumstances this time around thankfully, but rates have been high for a clear and difficult reason in the UK – rampant inflation, especially across 2022 and 2023.

Yesterday’s data showed CPI has dropped down to 3.2 per cent, but it’s still well above the target of 2%, which is why interest rates haven’t come down quite as quickly as some were hoping for.

Holly Evans18 December 2025 08:45

How rising inflation impacts your mortgage and savings

Inflation has been on a difficult path in 2025, initially dropping before surging back up from April onwards.

However, it appeared to peak over summer and the latest figures thankfully have inflation back on the downward path, with Consumer Prices Index (CPI) inflation rate falling back to 3.2 per cent in November.

While the rate is lowering, remember, that does not mean prices are coming down – it means they are rising more slowly than previously.

Read the full explainer from our business correspondent here:

Holly Evans18 December 2025 08:22

How did the FTSE 100 fare on Wednesday?

The FTSE 100 made strong headway on Wednesday, supported by a larger-than-expected cooling in inflation and a spike in the oil price.

The FTSE 100 index closed up 89.53 points, 0.9 per cent, at 9,774.32. It had earlier traded as high as 9,853.13.

The FTSE 250 ended 123.78 points higher, 0.6 per cent, at 22,164.76, and the AIM All-Share ended up 2.07 points, 0.3 per cent, at 751.48.

The soft UK inflation data sealed the Bank of England’s (BoE) expected interest rate cut on Thursday and increased the likelihood of further reductions in 2026, analysts said.

Holly Evans18 December 2025 07:55

Sharp drop in November inflation ‘green lights’ December rate cut

James Smith, developed market economist for ING, said the sharp drop in November inflation “green lights” a December rate cut.

“Christmas has come early for the doves at the Bank of England, with inflation coming in well below expectations in November,” he said.

Mr Smith said he was expecting inflation to edge higher in December, partly due to a seasonal spike in air fares.

However, he said the “latest drop in inflation fits into a broader body of evidence suggesting that price pressures are cooling”, adding: “We expect headline inflation to fall pretty close to 2 per cent by May.”

He is forecasting another two cuts to interest rates in February and April next year.

Alongside falling inflation, the MPC is expected to take note of other signs that the economy is cooling including rising unemployment, slower wage growth and stagnant economic growth.

Holly Evans18 December 2025 07:46

Still a ‘massive question mark’ over 2026 despite interest rates cut

Danni Hewson, head of financial analysis for AJ Bell, said: “Although 3.2 per cent is still way above the Bank of England’s target, it is expected to be the final piece in the puzzle which will enable rate setters to deliver their own festive gift to borrowers with an interest rate cut on Thursday.”

The Bank is tasked with bringing inflation down to the 2 per cent target level.

Ms Hewson added: “There are still massive question marks about what 2026 will bring and markets don’t expect the Bank of England to cut interest rates more than once or twice over the next year, so borrowers hoping to see a return to the ultra-low levels many people had become used to will have to adapt.”

Holly Evans18 December 2025 07:28

Bank of England poised for Christmas interest rate cut after inflation slows

Interest rates are set to be cut before Christmas after inflation fell to an eight-month low in November, economists think.

The Bank of England is widely expected to reduce borrowing costs to 3.75 per cent from 4 per cent when it next announces its next decision on Thursday.

This would bring borrowing costs down to the lowest rate since the beginning of February 2023.

Experts have said the Bank’s Monetary Policy Committee (MPC) will be encouraged by recent economic data to lower rates at its final meeting of the year.

In particular, the decision follows the release of the latest inflation data, which showed a bigger drop to Consumer Prices Index (CPI) inflation than analysts had been expecting.

The rate of CPI fell to 3.2 per cent in November, from 3.6 per cent in October, the Office for National Statistics (ONS) said.

This was largely driven by food and drink inflation which dropped to 4.2 per cent from 4.9 per cent, while alcohol and tobacco prices also eased.

Holly Evans18 December 2025 07:23