WazirX also aims to generate profits through future operations, and possibly set up a decentralised exchange [File]

| Photo Credit: REUTERS

The Indian crypto exchange WazirX announced the completion of users’ asset rebalancing process as it urged investors to support its restructuring scheme.

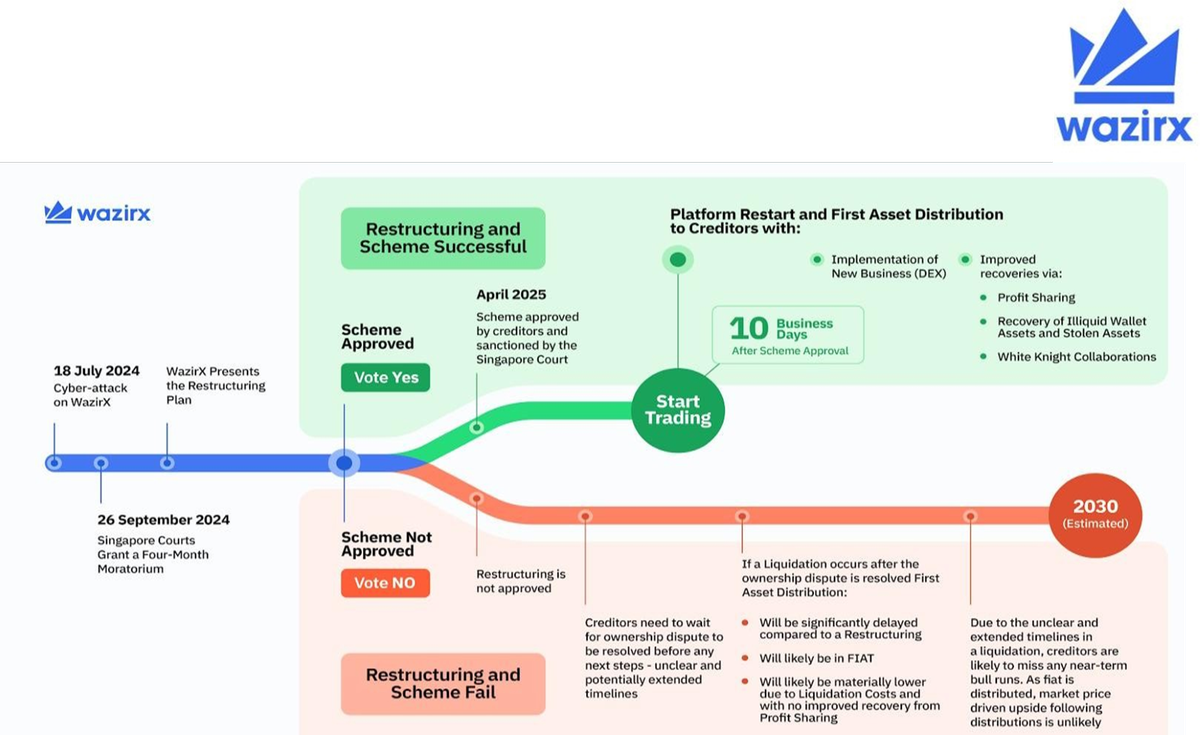

WazirX has said that in order to let the platform start operations once more and facilitate token recoveries, a majority of users will need to vote YES. The platform warned that not supporting the restructuring scheme could lead to longer delays, possibly lasting for even years.

“Within 10 business days of the Scheme being effective, the platform will restart, though subject to matters such as Court timelines. This distribution, which will be made in tokens, and made available once users vote YES for the Scheme, will represent ~85% of creditors’ Balances, valued as of 18 July 2024 1PM IST,” said WazirX in a press statement on Tuesday (February 10, 2025).

However, there are traders who believe that if their assets were not stolen in the hack, they are entitled to 100% of their portfolio balance.

CEO Nischal Shetty posted on X that all tokens listed on the rebalanced portfolio page will be part of the first distribution when WazirX restarts.

In addition to this, subsequent recoveries are slated to take place over the next three years as illiquid assets such as the stolen tokens are potentially converted into accessible assets. Such future distributions will be made through the purchase of recovery tokens, said WazirX. The exchange recently announced the freezing of the first tranche of stolen assets, valued at $3 million.

WazirX also aims to generate profits through future operations, and possibly set up a decentralised exchange (DeX).

“We are grateful to have reached this critical milestone. Completing the rebalancing process and preparing for distribution demonstrates Zettai’s deep commitment to protecting creditor interests and restoring the trust placed in the Platform. By targeting one of the fastest distribution timelines in the crypto industry, we hope to set a precedent for accountability, efficiency, and resilience in times of crisis,” said WazirX founder Nischal Shetty.

The WazirX hack on July 18 last year led to a loss of over $230 million in assets and highlighted the lack of governmental support and contingency measures for Indian crypto investors trading in a largely unregulated fintech market.

In a graphic provided by WazirX, the company warns that not supporting its restructuring scheme could lead to multi-year delays

| Photo Credit:

WazirX

Published – February 11, 2025 11:34 am IST